Bybit, a prominent cryptocurrency derivatives exchange, has rapidly gained popularity since its launch in 2018. Boasting a user-friendly interface, a wide array of trading products, and competitive fees, Bybit has attracted a diverse global community of traders, from beginners to seasoned professionals. This comprehensive article will delve into the intricacies of Bybit, exploring its features, functionalities, strengths, and weaknesses, and ultimately examining its role in the evolving landscape of the cryptocurrency market.

Bybit’s Features and Offerings

Bybit’s core offerings are designed to cater to the diverse needs of its users, from casual traders to institutional investors. The exchange’s wide range of features and services showcases its commitment to providing a robust and versatile platform for cryptocurrency trading.

Perpetual Contracts: Bybit’s Flagship Product

At the heart of Bybit’s offerings lie its perpetual contracts, which allow traders to speculate on the future price of cryptocurrencies without the constraints of expiration dates. These contracts are settled in USDT, providing traders with the flexibility to leverage their positions and potentially amplify their profits or losses.

Perpetual contracts utilize funding rates to maintain their price alignment with the underlying spot market. Traders must closely monitor these funding rates, as they can significantly impact the profitability of their positions. Additionally, Bybit’s leveraged trading capabilities enable traders to amplify their exposure, though this comes with the inherent risk of increased potential losses.

Another crucial aspect of Bybit’s perpetual contracts is the liquidation process. When a trader’s position experiences significant losses due to adverse market movements, it can result in the automatic closure of the position to protect the exchange from defaults. Traders must carefully manage their risk exposure and employ effective risk management strategies to navigate the complexities of leveraged trading.

Futures Contracts: Hedging and Speculation Opportunities

In addition to its perpetual contracts, Bybit also offers traditional futures contracts with predetermined expiry dates. These contracts allow traders to hedge against potential price fluctuations or capitalize on anticipated price movements in specific cryptocurrencies. Futures trading provides a valuable tool for traders seeking to diversify their portfolio and manage their risk exposure.

Options: Expanded Trading Opportunities

As of 2023, Bybit has launched options trading, further expanding its product offerings. Options trading gives traders the right, but not the obligation, to buy or sell a cryptocurrency at a specific price by a certain date. This feature opens up new trading strategies and opportunities for Bybit’s users, allowing them to better manage their risk and potentially generate income through options-based trading approaches.

Spot Trading: Diversifying Beyond Derivatives

Recognizing the diverse needs of its user base, Bybit also provides a spot trading platform for buying and selling cryptocurrencies directly. This feature offers traders the chance to diversify their portfolios and capitalize on short-term price movements in the spot market, complementing the exchange’s derivatives offerings.

Copy Trading: Learning from Experienced Traders

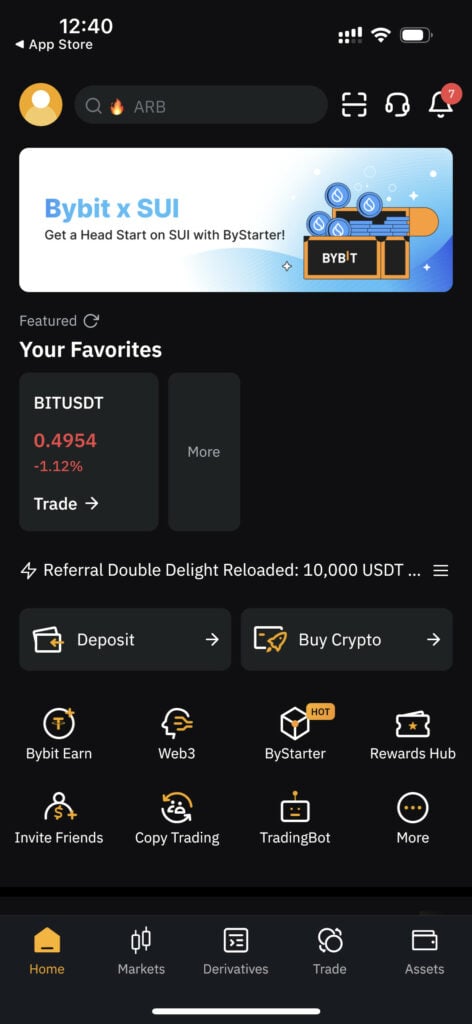

Bybit’s innovative copy trading feature allows novice traders to automatically mimic the trades of experienced traders. This is a valuable tool for individuals seeking to learn from the strategies of successful traders without having to develop their own trading expertise from scratch.

Bybit Earn: Passive Income Opportunities

To further enhance the value proposition for its users, Bybit offers the Bybit Earn feature, which provides opportunities for passive income generation. This includes options such as staking, dual investment, and saving accounts, allowing users to earn rewards on their cryptocurrency holdings.

Bybit Launchpad: Access to New Projects

The Bybit Launchpad platform enables users to participate in token launches and gain early access to promising new projects. This feature caters to traders and investors seeking to diversify their portfolios and potentially capitalize on the growth of emerging cryptocurrencies.

API Trading: Customized Automation

For experienced traders who prefer automated trading strategies, Bybit offers a robust Application Programming Interface (API) that allows for the development and implementation of custom trading bots and algorithms.

Trading and Investing with Bybit

Bybit’s comprehensive suite of trading and investment products caters to a wide range of user needs, from novice traders to seasoned professionals. The exchange’s user-friendly interface, advanced trading tools, and competitive fees make it an attractive choice for those seeking to navigate the complexities of the cryptocurrency market.

User-Friendly Interface

Bybit’s platform boasts an intuitive and visually appealing interface, making it accessible to traders of all experience levels. The exchange’s design prioritizes direct access to the information and tools needed to make informed trading decisions, ensuring a seamless user experience.

Advanced Trading Tools

Bybit’s platform is equipped with a robust selection of advanced trading tools, including comprehensive charting capabilities, a wide range of indicators, and a variety of order types. These features empower traders to construct and execute complex trading strategies, catering to the needs of both novice and experienced market participants.

Competitive Fees

Bybit’s trading fees are competitive compared to other cryptocurrency derivatives exchanges, making it an attractive option for traders seeking to maximize their returns. The exchange’s fee structure is transparent, and users can easily access information about the applicable fees for their trading activities.

Liquidity and Order Execution

Bybit has consistently attracted a significant volume of trading activity, resulting in a highly liquid trading environment. This ensures that traders can easily enter and exit positions without significantly impacting the market price. Additionally, the exchange’s advanced matching engine facilitates fast and efficient order executions, allowing traders to capitalize on fleeting market opportunities.

Global Community and Support

Bybit has fostered a vibrant and diverse global trading community, providing users with access to valuable insights, market analysis, and peer-to-peer support. The exchange also offers excellent customer support, with 24/7 live chat and email assistance to address user inquiries and resolve issues promptly.

Bybit’s Security and Safety Measures

In the rapidly evolving cryptocurrency landscape, security and safety are paramount concerns for both exchanges and their users. Bybit has demonstrated a strong commitment to protecting its platform and safeguarding user assets.

Multi-Layered Security Protocols

Bybit employs a suite of advanced security measures to secure its platform and user funds. These include multi-factor authentication (MFA), cold storage for the majority of user assets, and dedicated security protocols to detect and mitigate potential threats.

Regulatory Compliance

As a Singapore-based exchange, Bybit operates under the jurisdiction of the Monetary Authority of Singapore (MAS) and adheres to the regulatory frameworks governing the cryptocurrency industry in the city-state. This commitment to compliance instills confidence in Bybit’s users and reinforces the exchange’s dedication to transparency and integrity.

Transparency and Audits

Bybit maintains a high level of transparency, regularly publishing detailed information about its platform, operations, and user protections. The exchange has also undergone independent audits to validate the soundness of its security practices and the integrity of its financial records.

Incident Response and Mitigation

Despite Bybit’s robust security measures, the exchange has faced isolated incidents of platform outages and security breaches in the past. In such cases, Bybit has responded swiftly, implemented corrective measures, and provided transparent communication to its user community to address and mitigate the impacts of these events.

Bybit’s Fees and Charges

Bybit’s fee structure is a critical consideration for traders and investors when choosing a cryptocurrency exchange. The exchange’s competitive pricing, combined with its diverse range of trading products and services, makes it an attractive option for those seeking to maximize their returns.

Trading Fees

Bybit’s trading fees are generally competitive compared to other leading cryptocurrency derivatives exchanges. The exchange employs a maker-taker fee model, where traders who provide liquidity (makers) are charged lower fees than those who consume liquidity (takers). This structure incentivizes market making and contributes to the overall liquidity of the platform.

Withdrawal Fees

Bybit charges withdrawal fees for the transfer of cryptocurrencies from the exchange to external wallets. These fees vary depending on the specific cryptocurrency being withdrawn and are subject to change based on network conditions and the exchange’s operational costs.

Deposit Fees

Bybit generally does not charge any fees for depositing cryptocurrencies onto the platform. However, users may incur network fees (e.g., blockchain transaction fees) when making deposits, which are outside of the exchange’s control.

Financing Fees

For traders utilizing leveraged positions, Bybit charges periodic financing fees. These fees are based on the size of the open positions and the prevailing market conditions, reflecting the cost of maintaining the leveraged exposure.

Tiered Fee Structure

Bybit offers a tiered fee structure based on the trading volume of its users. Traders who achieve higher trading volumes are eligible for lower trading fees, incentivizing increased activity on the platform.

Bybit vs. Competitors: A Comparative Analysis

In the competitive landscape of cryptocurrency exchanges, Bybit faces off against a multitude of platforms, each offering its own unique features and value propositions. Understanding Bybit’s positioning within this dynamic ecosystem can provide valuable insights for traders and investors.

Perpetual Contracts and Leverage

When it comes to perpetual contracts and leveraged trading, Bybit compares favorably to other leading derivatives exchanges. The exchange’s competitive fees, high liquidity, and advanced trading tools position it as a compelling choice for traders seeking to capitalize on the volatility of the crypto markets.

Spot Trading and Fiat Integration

While Bybit’s focus on derivatives trading is a key strength, some competitors may offer a more extensive selection of spot trading pairs and more robust fiat on-ramp and off-ramp options. Traders who prioritize direct cryptocurrency-to-fiat conversions may find these features more appealing.

Product Diversification

In terms of product diversification, Bybit has steadily expanded its offerings, including the recent introduction of options trading. However, some exchanges may provide a more comprehensive suite of services, such as lending, staking, and cryptocurrency-based financial services, catering to a broader range of user needs.

Regulatory Compliance and Licensing

Bybit’s commitment to regulatory compliance and its licensing in Singapore are strengths that instill confidence in its users. However, traders and investors may also consider the regulatory standing and licensing of other exchanges, particularly in jurisdictions with more established cryptocurrency frameworks.

User Experience and Community

Bybit’s user-friendly interface, advanced trading tools, and vibrant global community are key advantages that have attracted a diverse user base. Nonetheless, some competitors may offer unique features or community-driven initiatives that resonate with specific trader demographics.

Conclusion

Bybit’s rapid rise as a leading cryptocurrency derivatives exchange can be attributed to its robust product offerings, user-centric approach, and focus on security and regulatory compliance. The exchange’s perpetual contracts, futures contracts, and newly launched options trading provide traders with a comprehensive suite of tools to navigate the volatility of the crypto markets.

Bybit’s strengths, such as its intuitive platform, competitive fees, and high liquidity, have made it an attractive choice for both novice and experienced traders. However, the exchange also faces some challenges, including limited fiat on-ramp and off-ramp options, as well as regulatory uncertainties that are inherent in the rapidly evolving cryptocurrency landscape.

As the adoption of cryptocurrencies continues to grow, Bybit’s position as a prominent derivatives exchange is likely to strengthen. The exchange’s commitment to innovation, security, and user satisfaction positions it well to maintain its leadership role and contribute to the ongoing transformation of the cryptocurrency market.

Ultimately, Bybit’s comprehensive offerings, robust security measures, and global user community make it a compelling option for traders and investors seeking to navigate the complexities of the crypto derivatives market. By continuously enhancing its platform and diversifying its product suite, Bybit is poised to play a significant role in the future of the cryptocurrency ecosystem.