As the cryptocurrency market continues to evolve, the BNB/USDT trading pair has become a focal point of interest for traders and investors alike. Binance Coin (BNB), the native token of the Binance exchange, has emerged as a prominent player in the digital asset landscape, with its pairing against the stablecoin Tether (USDT) offering a unique opportunity to explore the dynamics of this intriguing market.

Analyzing BNB/USDT Price Movements

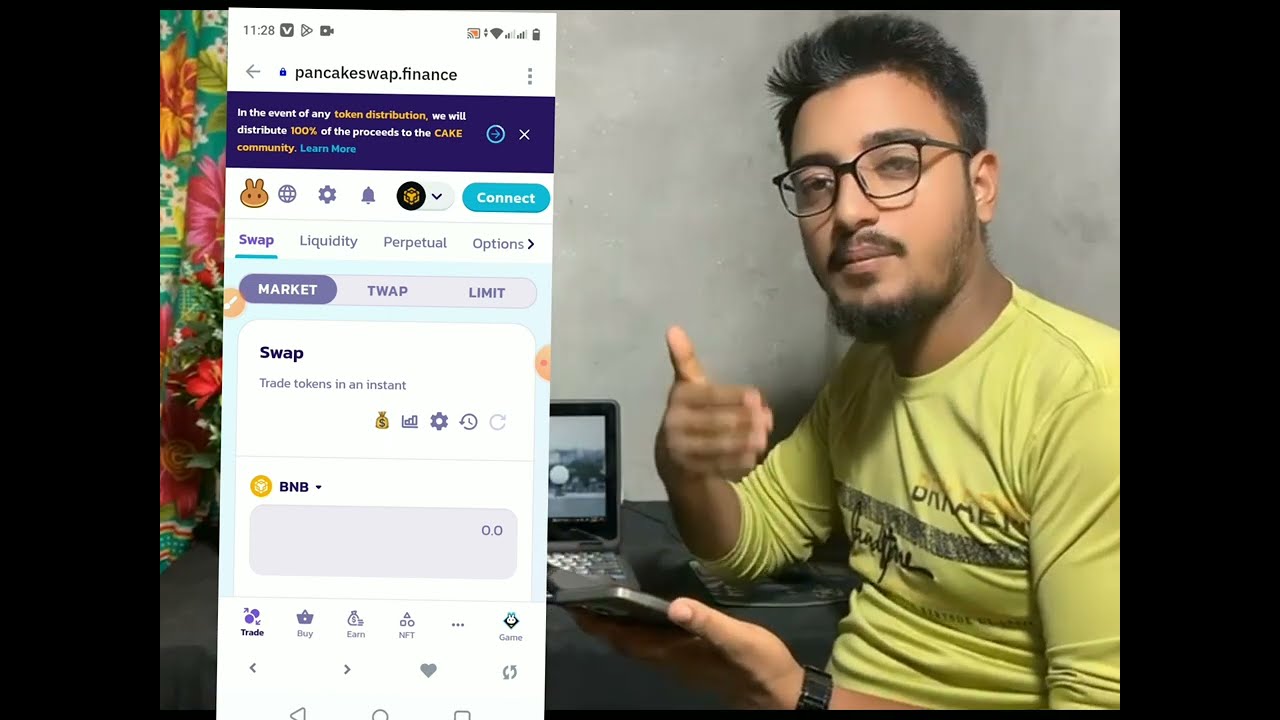

The BNB/USDT pair represents the exchange rate between Binance Coin and Tether, allowing traders to buy and sell BNB using the relative stability of USDT. Understanding the factors that influence the price movements of this pair is crucial for developing effective trading strategies and investment decisions.

Tracking BNB’s Trading Volume and Activity

One of the primary drivers of the BNB/USDT pair’s price action is the trading volume and overall activity on the Binance exchange. As the leading global cryptocurrency exchange, Binance’s influence on the BNB market is undeniable. Increased trading volume, especially for BNB-related pairs, can lead to higher demand and, consequently, an uptick in the BNB/USDT price. Conversely, a decline in trading activity may result in price decreases.

Evaluating Binance Ecosystem Developments

The growth and expansion of the Binance ecosystem, including the introduction of new features, services, and partnerships, can significantly impact the value of BNB. As the utility of the token expands within the Binance network, the demand for BNB is likely to increase, potentially leading to higher prices in the BNB/USDT pair.

Monitoring the Adoption of Binance Smart Chain

The Binance Smart Chain (BSC), a robust and cost-effective blockchain designed for decentralized applications (dApps), is another crucial factor influencing the BNB/USDT pair. As the adoption of BSC by developers and users continues to grow, the demand for BNB, the native currency of the network, is expected to rise, potentially driving up the BNB/USDT price.

Factors Influencing BNB/USDT Volatility

The BNB/USDT trading pair is subject to various factors that contribute to its overall volatility, ranging from macroeconomic conditions to market dynamics.

Cryptocurrency Market Sentiment

The overall sentiment in the broader cryptocurrency market plays a significant role in the price movements of the BNB/USDT pair. Positive market sentiment, characterized by increased investor confidence and optimism, can lead to a surge in BNB’s price, while negative sentiment may result in a decline.

Regulatory Landscape

Changes in the regulatory landscape surrounding cryptocurrencies, both globally and within specific jurisdictions, can significantly impact the BNB/USDT pair. Regulatory decisions and policies can influence market sentiment, leading to price fluctuations in the BNB/USDT trading pair.

Supply and Demand Dynamics

The supply of BNB and its distribution, as well as the demand from both institutional and retail investors, are crucial factors that shape the price movements of the BNB/USDT pair. Mechanisms such as token burns and changes in the BNB supply can impact the pair’s price, while increased adoption by institutional and retail investors can drive up demand and, consequently, the BNB/USDT price.

Trading Strategies for BNB/USDT

Navigating the BNB/USDT trading pair requires a well-defined strategy and a thorough understanding of the market dynamics. Several common trading strategies can be applied to this pair, each with its own unique advantages and considerations.

Trend Following

Identifying and capitalizing on the prevailing trends in the BNB/USDT pair can be a lucrative trading strategy. By utilizing technical indicators to analyze the trend direction, traders can enter long or short positions accordingly, aiming to ride the momentum and capture potential price movements.

Scalping

For traders seeking to capitalize on short-term price fluctuations, scalping can be a viable strategy for the BNB/USDT pair. This approach involves executing numerous trades within a limited timeframe, often employing technical indicators and automated trading bots to identify and exploit small price changes.

Arbitrage

Exploiting price discrepancies across different exchanges can present opportunities for BNB/USDT arbitrage trading. However, this strategy requires fast execution speeds and the ability to capitalize on narrow profit margins, making it a more sophisticated approach.

Risks and Considerations When Trading BNB/USDT

Trading the BNB/USDT pair, like any cryptocurrency market, involves inherent risks that must be carefully managed. Implementing a robust risk management strategy is crucial to protect your capital and navigate the volatility of the market.

Defining Risk Tolerance

Understand your own risk tolerance and set trading capital limits that you are comfortable with. This will help you avoid over-exposing your portfolio and minimize the potential for significant losses.

Employing Stop-Loss Orders

Utilize stop-loss orders to automatically exit positions when the price reaches a predetermined level, mitigating potential losses and managing risk effectively.

Diversifying Your Portfolio

Avoid over-concentrating your investments in the BNB/USDT pair. Diversify your portfolio across multiple assets to reduce overall risk and exposure to market fluctuations.

The Future of BNB/USDT and Binance Coin

The future outlook for the BNB/USDT trading pair appears promising, with several factors suggesting continued growth and potential for the Binance Coin ecosystem.

Binance’s Expansion and Ecosystem Developments

Binance’s ongoing expansion into new markets, services, and partnerships is likely to drive increased demand for BNB, potentially leading to further price appreciation in the BNB/USDT pair.

Adoption of Binance Smart Chain

As the Binance Smart Chain continues to gain traction among developers and users, the demand for BNB, the native currency of the network, is expected to rise, positively impacting the BNB/USDT trading pair.

Increasing Institutional Adoption

The growing interest from institutional investors in the cryptocurrency market, including BNB, could trigger significant capital inflows, potentially driving up the price of the BNB/USDT pair.

Conclusion

The BNB/USDT trading pair represents a fascinating intersection of the Binance ecosystem, the stability of Tether, and the broader cryptocurrency market dynamics. By understanding the factors that influence the price movements, traders and investors can develop informed strategies to navigate the volatility and potential of this dynamic pair. However, it is crucial to approach the BNB/USDT market with a cautious and well-informed mindset, prioritizing risk management and diversification to safeguard your investments. As the Binance ecosystem continues to evolve and the demand for BNB grows, the future outlook for the BNB/USDT pair remains promising, but with a keen awareness of the risks and challenges that may arise.